schedule c tax form llc

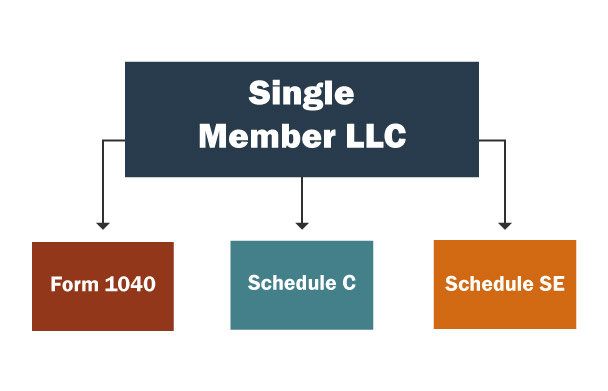

Schedule C is for two types of business - a sole proprietor or a single-member LLC that hasnt elected to be taxed as a corporation. Income Tax Return for Estates and Trusts.

How To Fill Out Schedule C For Doordash Independent Contractors

Schedule C Form 1040 is a form attached to your personal tax return that you.

. About Form 1099-MISC Miscellaneous Income. Ad Pay 0 to File all Federal Tax Returns Claim the credits you deserve. Return of Partnership Income.

Share E-Sign Instantly. Supervisor Information Form Please put a check in the box next to the type of application the applicant is submitting. 871 a and 881 a impose a tax of 30 of the fixed and determinable annual or periodical FDAP income received from sources within the United.

Information about Schedule C Form 1040 Profit or Loss from Business. Free 1040 with Schedule C. Only charge is the Annual Franchise Tax fee paid to maintain the LLC.

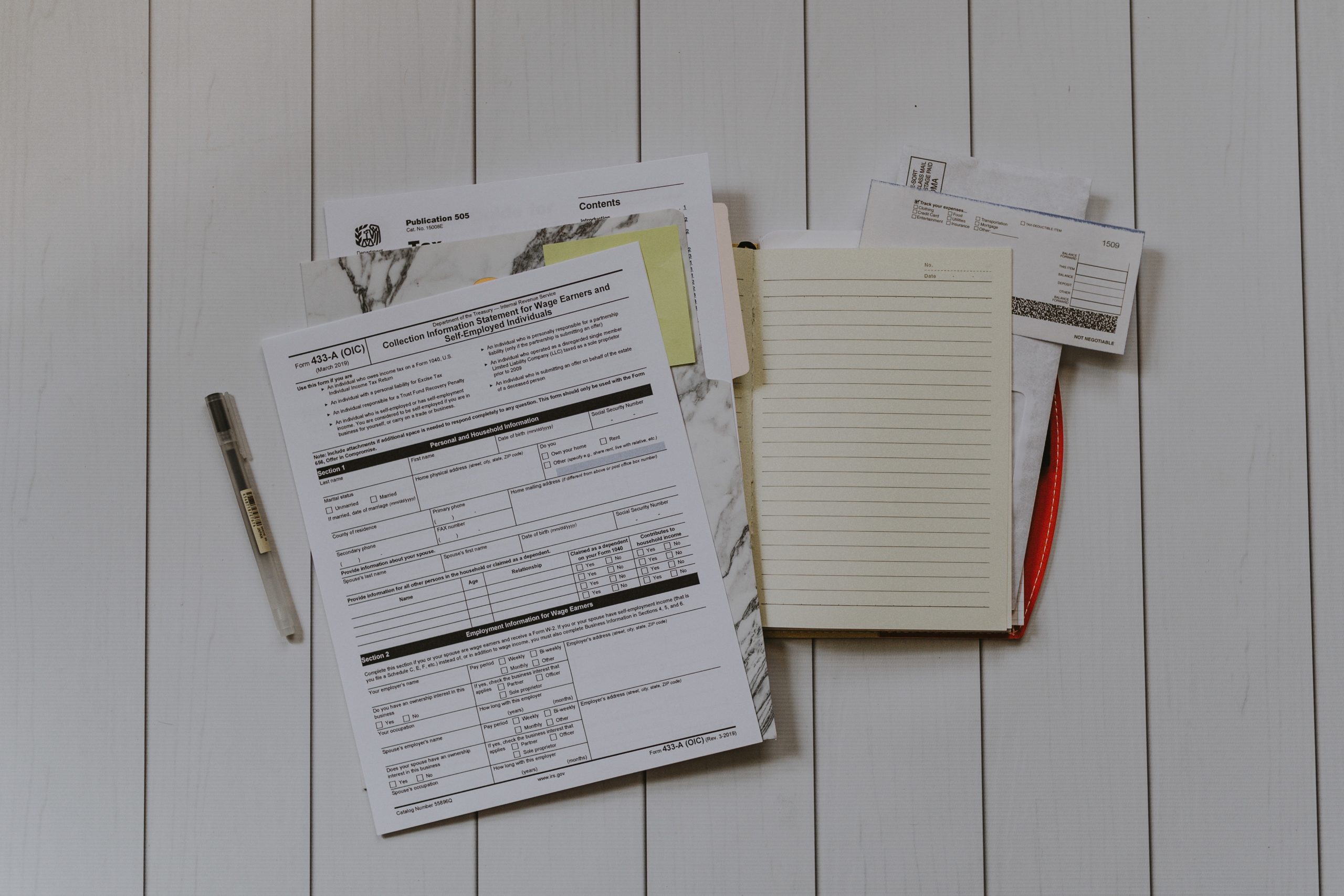

You ask a question about starting. The Schedule C tax form is used to report profit or loss from a business. Ad Write A Form Schedule C With Our Premium Fillable Templates- Finish Print In Minutes.

Complete Edit or Print Tax Forms Instantly. The Schedule C is an IRS form that collects data about your small business and then calculates your net profit. Get Trusted Legal Forms.

The profit is the amount of money you made after covering all. The owners of an LLC are members. You and your spouse must each report your individual shares of the income generated.

A limited liability company LLC blends partnership and corporate structures. Schedule C is a tax form for small business owners who are sole proprietors or single-member LLC owners. Ad Access IRS Tax Forms.

About Form 1041 US. This is a friendly reminder that rsmallbusiness is a question and answer subreddit. New York City.

You can form an LLC to run a business or to hold assets. It is a form that sole proprietors single owners of businesses must fill out in the United States when. Application Note to supervisor.

File your profits and losses fast. The IRS website has a copy of the Schedule C tax form as well as Instructions for Schedule C. Even simple sole proprietorships usually require multiple other.

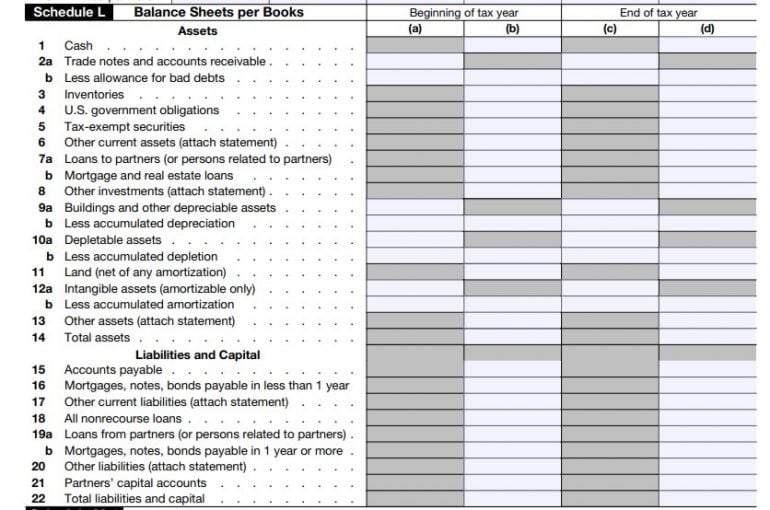

You will file the LLCs federal income tax return using IRS Form 1065 US. The Schedule C tax form is not for. Free Phone Evaluation - Call 201 587-1500 212 380-8117 - Samuel C Berger PC is dedicated to serving our clients with a range of legal services including Single-Member LLC and.

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

Schedule C What Is It For And Who Has To Fill It Global Tax

What Do The Expense Entries On The Schedule C Mean Support

Irs Schedule C 1040 Form Pdffiller

Federal Corporate Tax Preparation Preparing C Corp S Corp And Llc

What Is An Irs Schedule C Form

How To Fill Out Your Schedule C Perfectly With Examples

Solved Schedule C For Llc How To Report Income From A Foreign Cooperation

How To File Your Llc Taxes Truic

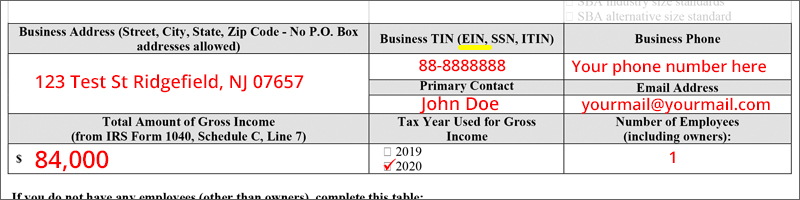

New Self Employment Gross Income Ppp Loan Application Guide

Irs Form 1065 Instructions Step By Step Guide Nerdwallet

Schedule C Form 1040 Free Fillable Form Pdf Sample Formswift

Schedule C Form 1040 Sole Proprietor Independent Contractor Llc How To Fill Out Form Schedule C Youtube

Additional Schedule C Wilson Financial Wealth Management And Financial Planning

What Is A Schedule C Irs Form Turbotax Tax Tips Videos

What Is A Schedule C Tax Form Used For Mycorporation

Guide To Filing Business Taxes